Moneytree, established in 2013, is a financial technology company that has emerged as a prominent provider of financial management tools in Japan and Australia. The company’s core objective is to empower individuals and businesses to make informed financial decisions by offering comprehensive tools and information for effective money management. The company’s service portfolio includes personal finance management, budgeting tools, expense tracking, and investment monitoring.

Moneytree’s mobile application, compatible with both iOS and Android platforms, enables users to access their financial data remotely. The app allows users to integrate their bank accounts, credit cards, and investment accounts, providing a holistic view of their financial status. Additionally, it offers personalized insights and recommendations to guide users towards more prudent financial choices.

Key Takeaways

- Moneytree is a personal finance management app that helps users track their expenses, manage their budgets, and stay on top of their financial goals.

- Moneytree offers features such as expense tracking, budget management, bill reminders, and investment tracking, as well as services like credit score monitoring and financial advice.

- Users praise Moneytree for its user-friendly interface, intuitive design, and responsive customer support, making it easy to manage their finances on the go.

- Moneytree prioritizes security and privacy, using bank-level encryption and secure data storage to protect users’ financial information.

- While Moneytree offers a free basic plan, there are fees for premium features and services, such as credit score monitoring and investment tracking, which may not be suitable for all users.

Features and Services Offered by Moneytree

Comprehensive Financial Overview

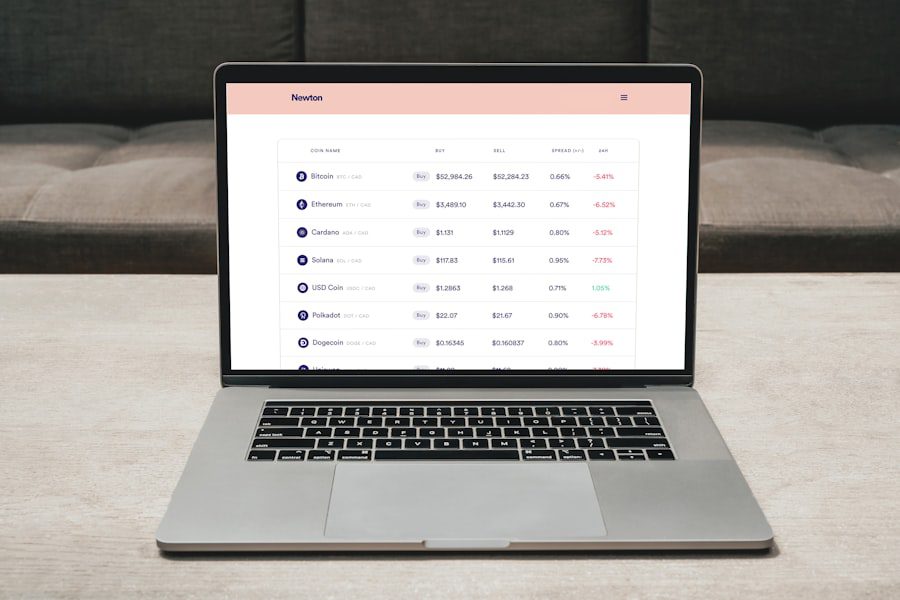

One of the key benefits of the Moneytree app is its ability to link to multiple financial accounts, including bank accounts, credit cards, and investment accounts. This allows users to get a comprehensive view of their financial situation in one place, making it easier to track expenses, monitor cash flow, and make informed decisions about their money.

Personalized Budgeting and Insights

In addition to account linking, Moneytree also offers budgeting tools that allow users to set spending limits for different categories and track their progress over time. The app also provides personalized insights and recommendations based on users’ spending habits, helping them identify areas where they can save money and make smarter financial decisions.

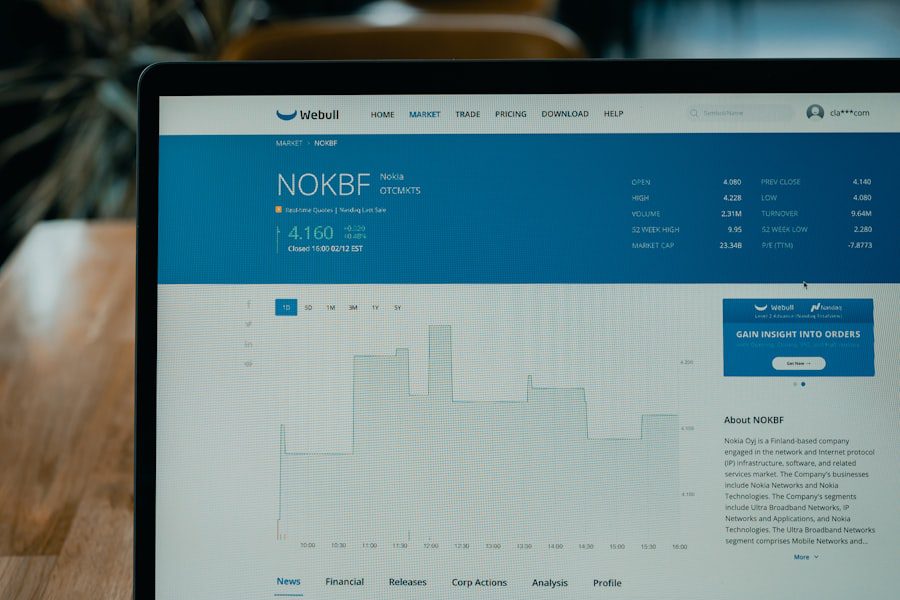

Investment Tracking and Analysis

Moneytree also offers investment tracking tools, allowing users to monitor the performance of their investment portfolios and stay on top of market trends.

User Experience and Customer Support

Moneytree is designed with user experience in mind, offering a clean and intuitive interface that makes it easy for users to access their financial information and take advantage of the app’s features. The app’s dashboard provides a comprehensive overview of users’ financial situation, including account balances, recent transactions, and spending trends. Users can also customize their dashboard to display the information that is most relevant to them, making it easy to stay on top of their finances.

In terms of customer support, Moneytree offers a range of resources to help users get the most out of the app. This includes a comprehensive help center with articles and tutorials on how to use the app’s features, as well as a dedicated support team that is available to answer any questions or concerns users may have. The app also provides personalized insights and recommendations based on users’ spending habits, helping them identify areas where they can save money and make smarter financial decisions.

Security and Privacy Measures

| Security and Privacy Measures | Metrics |

|---|---|

| Encryption | 256-bit AES encryption |

| Firewall | Active firewall protection |

| Privacy Policy | Compliance with GDPR and CCPA |

| Two-Factor Authentication | Percentage of users using 2FA |

Moneytree takes security and privacy seriously, implementing a range of measures to protect users’ financial information. The app uses bank-level encryption to secure users’ data, ensuring that their personal and financial information is kept safe from unauthorized access. Moneytree also requires users to set up a secure login method, such as a PIN or biometric authentication, to access their account, adding an extra layer of protection.

In addition to encryption and secure login methods, Moneytree also monitors for any suspicious activity on users’ accounts and alerts them if any unusual transactions are detected. The app also allows users to set up notifications for account activity, providing them with real-time updates on their finances and helping them stay on top of any potential security issues. Overall, Moneytree’s commitment to security and privacy gives users peace of mind knowing that their financial information is safe and secure.

Fees and Charges

Moneytree offers a range of pricing plans to suit different needs and budgets. The app is free to download and use, with basic features such as account linking, budgeting tools, and expense tracking available at no cost. However, Moneytree also offers premium features for users who want access to more advanced tools and personalized insights.

The premium version of Moneytree includes additional features such as investment tracking, custom categories for expenses, and the ability to export data to other financial management tools. The premium version is available for a monthly or annual subscription fee, with discounts available for annual subscriptions. Overall, Moneytree’s pricing plans are designed to provide flexibility for users while offering value for those who want access to more advanced features.

Pros and Cons of Using Moneytree

Comprehensive Financial Management

The app’s ability to link to multiple financial accounts provides users with a comprehensive view of their finances, making it easier to track expenses, monitor cash flow, and make informed decisions about their money.

User-Friendly Interface and Security

The app’s intuitive interface makes it easy for users to access their financial information and take advantage of its features, while its commitment to security and privacy gives users peace of mind knowing that their financial information is safe and secure.

Limitations and Drawbacks

However, there are also some cons to using Moneytree, including the fact that some advanced features are only available with a premium subscription. While the basic version of the app offers a range of useful tools for managing finances, users who want access to more advanced features such as investment tracking will need to pay for a premium subscription. Additionally, some users may find the pricing plans for the premium version to be too expensive for their budget.

Overall Assessment

Overall, while Moneytree offers a range of useful features for managing finances, it may not be the best option for users who are looking for a completely free financial management tool.

Conclusion and Final Thoughts

In conclusion, Moneytree is a comprehensive financial management tool that offers a range of features and services to help individuals and businesses manage their finances more effectively. The app’s ability to link to multiple financial accounts provides users with a comprehensive view of their finances, while its budgeting tools, expense tracking, and investment tracking features help users make smarter financial decisions. The app’s intuitive interface makes it easy for users to access their financial information and take advantage of its features, while its commitment to security and privacy gives users peace of mind knowing that their financial information is safe and secure.

Overall, while there are some cons to using Moneytree such as the fact that some advanced features are only available with a premium subscription, the app offers a range of useful tools for managing finances. Whether you’re an individual looking to take control of your personal finances or a business looking for a comprehensive financial management solution, Moneytree has something to offer. With its range of features and commitment to security and privacy, Moneytree is a valuable tool for anyone looking to manage their finances more effectively.

If you’re interested in learning more about personal finance and money management, you may want to check out this article on cashadvance.express about cash advance options in Colorado, West Virginia, and Florida. Cash Advance Options in Colorado offers valuable information on how to access quick cash when you need it most. Whether you’re facing unexpected expenses or simply need some extra funds to cover bills, understanding your options for cash advances can be a helpful tool in managing your finances. And when it comes to tracking your spending and budgeting, Moneytree can be a useful resource to help you stay on top of your financial goals.

FAQs

What is Moneytree?

Moneytree is a personal finance management app that allows users to track their expenses, create budgets, and manage their financial accounts in one place.

How does Moneytree work?

Moneytree works by connecting to the user’s bank accounts and credit cards to automatically track their spending and categorize their transactions. Users can also manually input cash transactions and set budget goals.

Is Moneytree safe to use?

Moneytree uses bank-level security measures to protect user data and financial information. It is also regulated by financial authorities in the countries where it operates, such as the Financial Services Agency in Japan.

What features does Moneytree offer?

Moneytree offers features such as expense tracking, budgeting tools, bill reminders, investment tracking, and the ability to sync with multiple financial accounts.

Is Moneytree free to use?

Moneytree offers a free basic version with limited features, as well as a premium version with additional features such as custom categories, advanced budgeting, and investment tracking.

Can Moneytree help with saving money?

Moneytree can help users save money by providing insights into their spending habits, setting budget goals, and tracking their progress towards financial goals.