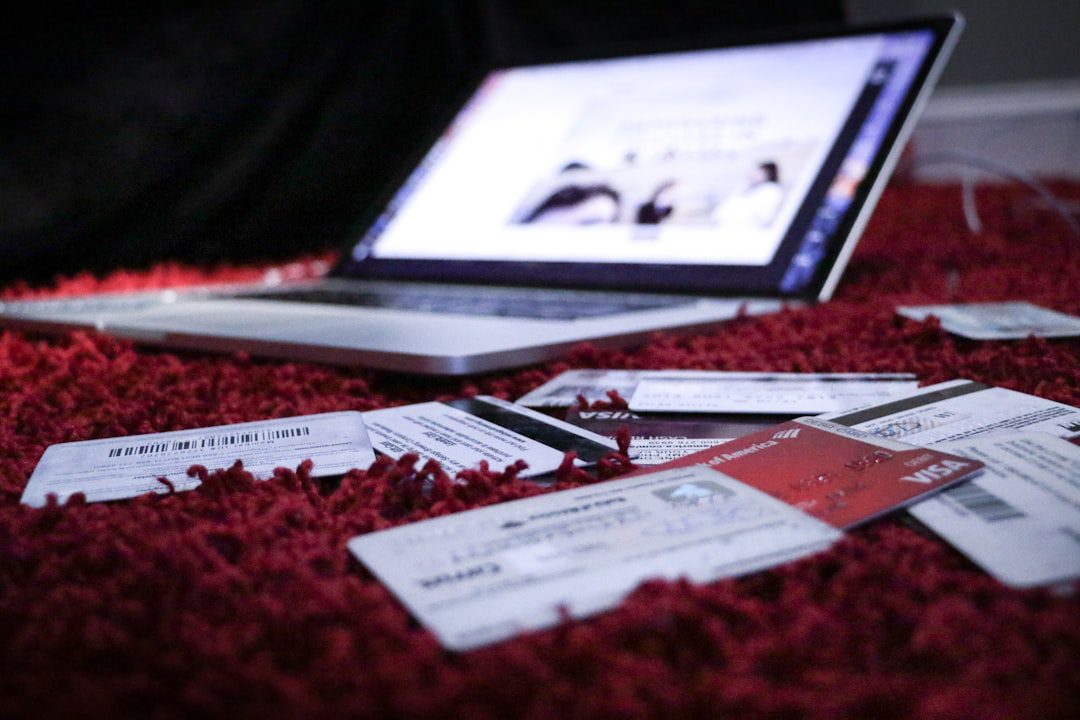

Your credit score is a numerical representation of your creditworthiness, ranging from 300 to 850. Lenders use this score to assess your eligibility for loans. It is calculated based on factors such as payment history, credit utilization, length of credit history, types of credit used, and new credit inquiries.

Scores below 580 are typically considered poor or bad credit. Understanding your credit score is essential when applying for a bad credit loan, as it provides insight into how lenders perceive your financial responsibility. A low credit score can make qualifying for traditional loans challenging, but some lenders specialize in bad credit loans and are willing to work with individuals who have less-than-perfect credit.

Regular monitoring of your credit score and reviewing your credit report for errors or inaccuracies is important. By understanding the factors that contribute to your credit score, you can take steps to improve it over time, potentially qualifying for better loan terms in the future. When seeking a bad credit loan, it’s crucial to research lenders that specialize in this area.

These lenders are more likely to consider your application and offer loan options tailored to individuals with lower credit scores. Compare terms and conditions from different lenders to find the best fit for your financial situation. Look for reasonable interest rates, flexible repayment terms, and transparent fees.

Various types of bad credit loans are available, including personal loans, payday loans, and installment loans. Each type has its own set of terms and conditions, so carefully review the details before making a decision. Consider the lender’s reputation and customer reviews to ensure they are reputable and trustworthy.

By researching lenders that specialize in bad credit loans, you can increase your chances of finding a loan that meets your needs and potentially helps improve your financial situation.

Key Takeaways

- Your credit score is a crucial factor in determining your loan eligibility and interest rates.

- Research lenders that specialize in bad credit loans to find the best options for your situation.

- Gather necessary documentation such as proof of income and employment history to streamline the loan application process.

- Explore secured loan options, which may be more accessible for individuals with bad credit.

- Consider a co-signer to increase your chances of loan approval and secure better terms.

- Work on improving your credit score to qualify for better loan options in the future.

- Understand the terms and conditions of the loan, including interest rates, fees, and repayment terms, before committing to any agreement.

Gathering Necessary Documentation

Required Documents

Lenders typically require proof of income, such as pay stubs or tax returns, to verify your ability to repay the loan. Additionally, you may need to provide identification, such as a driver’s license or passport, to confirm your identity.

Additional Documentation

Other documentation that may be required includes bank statements, proof of residency, and references. By gathering all the necessary documentation in advance, you can streamline the application process and increase your chances of approval.

Accuracy and Preparation

It’s crucial to ensure that all the information provided is accurate and up to date to avoid any delays or complications with your application. If you have any questions about the documentation required, don’t hesitate to reach out to the lender for clarification. Being prepared with all the necessary documentation will demonstrate your readiness and responsibility as a borrower.

Exploring Secured Loan Options

If you have bad credit, exploring secured loan options may be a viable solution to obtaining a loan with more favorable terms. A secured loan requires collateral, such as a vehicle or property, to secure the loan amount. By offering collateral, you reduce the risk for the lender, making it easier to qualify for a loan even with bad credit.

Secured loans typically offer lower interest rates and higher loan amounts compared to unsecured loans. Before pursuing a secured loan, it’s important to carefully consider the potential risks involved. If you default on a secured loan, the lender has the right to repossess the collateral used to secure the loan.

This could result in the loss of your vehicle or property, so it’s crucial to only pursue a secured loan if you are confident in your ability to repay the loan as agreed. Additionally, be sure to compare offers from different lenders to find the most favorable terms for your secured loan.

Considering a Co-Signer

Another option for obtaining a bad credit loan is to consider a co-signer. A co-signer is someone with good credit who agrees to take on responsibility for the loan if you are unable to make payments. Having a co-signer can significantly improve your chances of approval and may even lead to more favorable loan terms, such as lower interest rates and higher loan amounts.

When considering a co-signer, it’s important to choose someone who trusts and believes in your ability to repay the loan. Keep in mind that if you default on the loan, it will negatively impact both your credit and the co-signer’s credit. Open and honest communication with your co-signer is crucial to ensure that both parties understand their obligations and responsibilities.

Before pursuing a bad credit loan with a co-signer, carefully consider the potential impact on your relationship and make sure you are both on the same page regarding the terms of the loan.

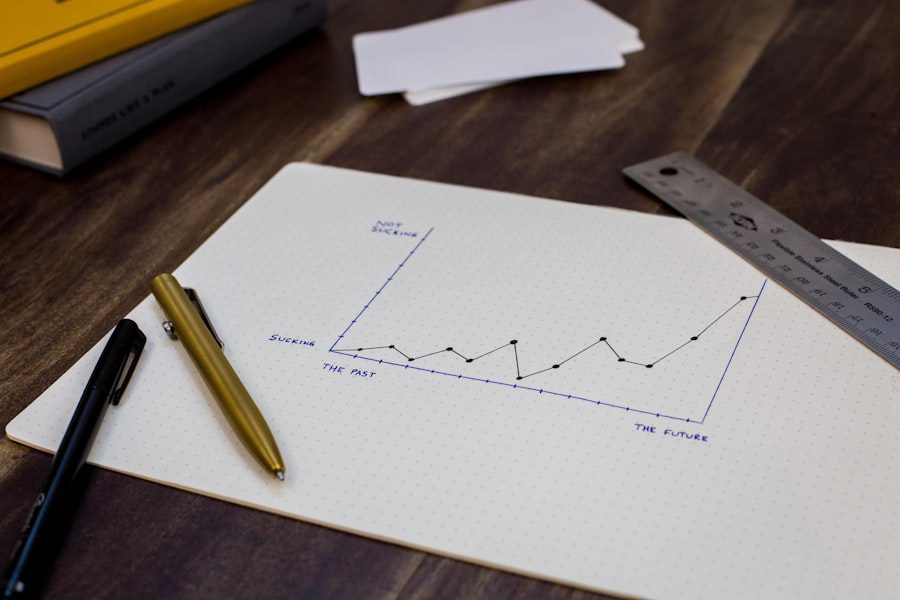

Improving Your Credit Score

While it may take time, there are steps you can take to improve your credit score and increase your chances of qualifying for better loan terms in the future. Start by making all of your payments on time and in full each month. Payment history is one of the most significant factors that contribute to your credit score, so consistently paying your bills on time can have a positive impact on your credit.

Additionally, work on paying down existing debt and avoid taking on new debt whenever possible. High levels of debt relative to your available credit can negatively impact your credit score. By reducing your debt-to-credit ratio, you can improve your credit utilization and demonstrate responsible financial management.

Regularly monitoring your credit report for errors or inaccuracies is also essential for improving your credit score. If you notice any discrepancies, be sure to dispute them with the credit bureaus to have them corrected. By taking proactive steps to improve your credit score, you can increase your chances of qualifying for better loan terms in the future.

Understanding the Terms and Conditions of the Loan

Understanding the Loan Agreement

Pay close attention to any potential penalties for late payments or early repayment, as these can significantly impact the overall cost of the loan. If there are any aspects of the loan agreement that are unclear or confusing, don’t hesitate to ask the lender for clarification. It’s crucial to fully understand what you are agreeing to before committing to a loan. If necessary, seek advice from a financial advisor or trusted professional who can help you navigate the terms and conditions of the loan.

Making an Informed Decision

By understanding the terms and conditions of the loan, you can make an informed decision about whether the loan is right for you and avoid any surprises down the road. Remember that once you sign the loan agreement, you are legally bound by its terms, so take the time to carefully review and understand all aspects of the loan before proceeding.

Improving Your Chances of Approval

Understanding your credit score and taking steps to improve it over time can increase your chances of qualifying for better loan terms in the future. Researching lenders that specialize in bad credit loans and gathering all necessary documentation will help streamline the application process and increase your chances of approval. Exploring secured loan options or considering a co-signer are additional strategies for obtaining a bad credit loan with more favorable terms.

If you are struggling to obtain a loan with poor credit, you may want to consider exploring the options available through Cash Advance Express. They offer a variety of loan products that cater to individuals with less than perfect credit. In fact, they have specific resources for residents of Missouri and Idaho, making it easier for those in these states to access the financial assistance they need. For more information on their services, you can check out their website here.

FAQs

What is a poor credit score?

A poor credit score typically falls below 600 and is a reflection of a person’s credit history, including late payments, high credit card balances, and other negative factors.

Can I still obtain a loan with poor credit?

Yes, it is still possible to obtain a loan with poor credit, although it may be more challenging and come with higher interest rates.

What are the options for obtaining a loan with poor credit?

Options for obtaining a loan with poor credit include applying for a secured loan, finding a co-signer, or exploring alternative lenders who specialize in working with individuals with poor credit.

What is a secured loan?

A secured loan requires the borrower to put up collateral, such as a car or property, to secure the loan. This reduces the risk for the lender and may make it easier for individuals with poor credit to qualify for a loan.

What is a co-signer?

A co-signer is someone with good credit who agrees to take on the responsibility of the loan if the primary borrower is unable to make payments. This can help individuals with poor credit qualify for a loan.

What should I consider before obtaining a loan with poor credit?

Before obtaining a loan with poor credit, it’s important to carefully consider the terms and interest rates, as well as the impact on your overall financial situation. It’s also important to explore options for improving your credit in the future.